Last Updated: January 22, 2025

Our analysts recently conducted a meta-analysis on SaaS valuation multiples, aggregating publicly available data on SaaS dealflow from Q4 2022 – Q1 2025. The table below shows the average valuation multiples private SaaS companies are selling for today, broken down by the 3 most common valuation models: EBITDA, Revenue, and SDE. The data is further segmented by SaaS business type and EBITDA/Revenue/SDE range.

(Sources)

2025 SaaS EBITDA Multiples – Private Sector

| Business Type | EBITDA Range | ||

| $1-3M | $3-5M | $5-10M | |

| Advertising / AdTech | 10.3x | 10.5x | 12.3x |

| Agriculture / AgTech | 9.7x | 11.4x | 12.1x |

| Communication | 12.3x | 13.1x | 14.2x |

| Customer Relationship Management (CRM) | 12.4x | 13.4x | 15x |

| Cybersecurity | 12.9x | 14.4x | 15.8x |

| E-Commerce | 13.3x | 14.7x | 15.4x |

| Education / EdTech | 11x | 12.1x | 14.8x |

| Enterprise Resource Planning (ERP) | 12.5x | 14.2x | 14.9x |

| Enterprise | 13.9x | 14.5x | 15.2x |

| Environmental / CleanTech | 12.5x | 14.1x | 16x |

| Financial / Fintech | 12.3x | 14.5x | 15.5x |

| Healthcare / MedTech | 11.6x | 13.5x | 15.1x |

| Human Resources (HR) | 15.6x | 17.1x | 19.3x |

| Legal / Legal Tech | 10.8x | 11.5x | 12.8x |

| Real Estate / Proptech | 9.3x | 10.4x | 11.5x |

2025 SaaS Revenue Multiples – Private Sector

| Business Type | Revenue Range | ||

| $1-5M | $6-10M | $10-75M | |

| Advertising / AdTech | 4.5x | 5.6x | 7.1x |

| Agriculture / AgTech | 5.2x | 6.2x | 8.5x |

| Communication | 5.9x | 6.6x | 7.4x |

| Customer Relationship Management (CRM) | 5.7x | 7x | 8.2x |

| Cybersecurity | 6.1x | 6.9x | 8x |

| E-Commerce | 6.4x | 7.4x | 9.4x |

| Education / EdTech | 5.4x | 6.1x | 6.9x |

| Enterprise | 5.8x | 7.4x | 9.4x |

| Enterprise Resource Planning (ERP) | 6.6x | 8.1x | 9.6x |

| Environmental / CleanTech | 6.2x | 7.5x | 8.4x |

| Financial / FinTech | 5x | 5.5x | 7.7x |

| Healthcare / MedTech | 6.1x | 7.2x | 9.3x |

| Human Resources (HR) | 6.1x | 7.2x | 9.2x |

| Legal / LegalTech | 5.1x | 6.4x | 7.4x |

| Real Estate / PropTech | 5.4x | 6.8x | 8.2x |

2025 SaaS SDE Multiples – Private Sector

| Business Type | SDE Range | ||

| $500k-1M | $1M-2M | $2M-3M | |

| Advertising / AdTech | 6.2x | 7.5x | 8.4x |

| Agriculture / AgTech | 7x | 8.4x | 9.6x |

| Communication | 7.7x | 8.3x | 8.7x |

| Customer Relationship Management (CRM) | 7.6x | 8.3x | 8.9x |

| Cybersecurity | 7.5x | 8.4x | 9.5x |

| Education / EdTech | 6.3x | 7.3x | 8.4x |

| Environmental / CleanTech | 7.1x | 8.2x | 9.1x |

| E-Commerce | 7.1x | 8.6x | 9.4x |

| Enterprise | 7.8x | 8.8x | 10.5x |

| Enterprise Resource Planning (ERP) | 6.2x | 7x | 8.1x |

| Financial / Fintech | 7.6x | 8.4x | 9.2x |

| Healthcare / MedTech | 7.6x | 8.8x | 9.8x |

| Human Resources (HR) | 8x | 8.5x | 9.7x |

| Legal / LegalTech | 7.1x | 8.4x | 9x |

| Real Estate / PropTech | 6.6x | 7.9x | 9.1x |

The following sections provide further context to the data above by offering a high-level overview of the current M&A environment for private SaaS companies, as well as suggestions for how to sell a SaaS company in Q1 2025.

The 2025 M&A Market for SaaS Companies

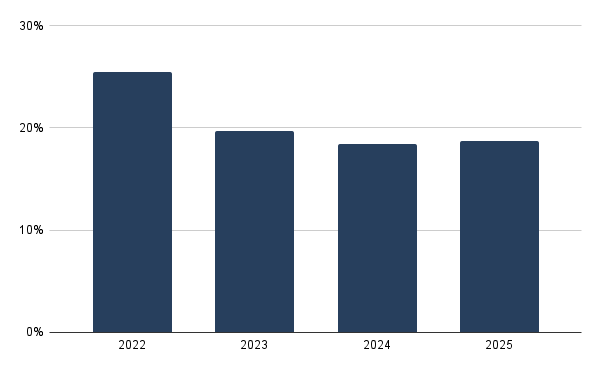

Globally, the SaaS industry is valued at ~$273 billion in 2024, most of which are enterprises. the industry has experienced steady declines in CAGR 18.7% (Up from 18.4% in 2024), however it is nonetheless expected to more than triple by 2028, coming to a total of $720.4 billion. These numbers are on track with the industry’s historical expansion, having increased 7x over the last 10 years as more companies are seeking cloud-based services for their company.

SaaS CAGR, 2022-2025

As the economy slowly picks back up following the economic downturn that began in Q3 2022, SaaS companies are cautiously optimistic moving further into 2025. As of Q1 2024, industry reports cited SaaS revenue multiples slowly picking back from their three-year low of ~5.5x, which now sits closer to ~6.1x. There is still a long ways to go, however, until they hit the record high set in Q3 2021of 9.8x. This slow movement towards recovery reflects the trends in nearly all observed industries, as the volatility of an election year remains uncertain and the promise of lowering interest rates still loom in the near future.

Average EBITDA Multiples for SaaS Companies [Private], H1 2019 – H1 2025

As the economy recovers, SaaS company owners seeking to sell their company are contending with several challenges:

- Increased business-lending interest rates as a result of an uncertain market

- Massive sunk investments in company operations, leading to a difficulty in properly valuating the company’s worth

These factors contribute to the somewhat sparser M&A market of 2025. While deal volume and overall valuations are likely to pick up substantially in H2 2025 as interest rates continue to lower, PE firms and strategics have reported that business owners are increasingly negotiating the sale of their business through M&A advisors who are experienced with SaaS and technology.

Related: See our list of the Top M&A Advisory Firms in the US

Common SaaS Valuation Models

Valuations for SaaS companies can vary quite a bit because most are unprofitable in the early stages of growth as they invest in scaling. As a result, models that look at company earnings (ARR, YoY Growth Rate, Gross Margin) are preferable for sellers as opposed to those that look solely at EBITDA. In general, larger companies, i.e. those with >$25 million revenue, will want to emphasize EBITDA in an M&A process whereas smaller companies will want to suggest alternative valuation models that focus on projected growth.

Below is a comparison of the 3 most common valuation models for SaaS companies.

Common SaaS Valuation Models

| Model | Equation | Best For |

| EBITDA | Net Income + Interest + Taxes + Depreciation + Amortization | Established companies with $5M in annual recurring revenue or more |

| Seller’s Discretionary Earnings (SDE) | Total Revenue – (Operating Expenses/Cost of Goods Sold) –Owner Compensation | Smaller SaaS Companies making less than $5M in annual recurring revenue.SaaS companies with a single owner |

| Revenue | Sum of subscription revenue for the year + Recurring revenue from add-ons and upgrades | Private SaaS companies who have already been offered a valuation by a prospective buyer |

Non-Financial Factors Affecting SaaS Valuations

When going to market with a business, SaaS owners and investors should also be aware of the following non-financial factors that have a substantial affect on valuation.

Non-Financial Factors Affecting SaaS Valuations

| Factor | Significance to SaaS | Formula | SaaS Benchmark |

| Growth Rate | SaaS businesses that are able to handle the stresses of scaling are more likely to earn a higher valuation from the buyer. | Previous Year Value – Current ValuePrevious Year Value 100 | 7-8% |

| Future Proofing | SaaS is a fast-moving industry in which products often have a short shelf-life before they are replaced. | See our article on selling/valuing a SaaS company. | 11-15/25 |

| Cost to Replicate | The value of SaaS companies is in the proprietary nature of their software. If this software is easy to replicate, buyers have less reason to purchase their company. | # lines of codeX# months required to generate original code | Small: 25,000+Medium: 50,000+Large: 100,000+ |

Further Questions

I believe in bringing transparency to M&A, which is why we publish valuation multiples. If you have any questions, I’m happy to offer advice from the perspective of someone who has sold multiple companies to a variety of buyers. You can reach me using the address below or by using the contact page on this website.

Last Updated: January 22, 2025

Our analysts recently conducted a meta-analysis on SaaS valuation multiples, aggregating publicly available data on SaaS dealflow from Q4 2022 – Q1 2025. The table below shows the average valuation multiples private SaaS companies are selling for today, broken down by the 3 most common valuation models: EBITDA, Revenue, and SDE. The data is further segmented by SaaS business type and EBITDA/Revenue/SDE range.

(Sources)

2025 SaaS EBITDA Multiples – Private Sector

| Business Type | EBITDA Range | ||

| $1-3M | $3-5M | $5-10M | |

| Advertising / AdTech | 10.3x | 10.5x | 12.3x |

| Agriculture / AgTech | 9.7x | 11.4x | 12.1x |

| Communication | 12.3x | 13.1x | 14.2x |

| Customer Relationship Management (CRM) | 12.4x | 13.4x | 15x |

| Cybersecurity | 12.9x | 14.4x | 15.8x |

| E-Commerce | 13.3x | 14.7x | 15.4x |

| Education / EdTech | 11x | 12.1x | 14.8x |

| Enterprise Resource Planning (ERP) | 12.5x | 14.2x | 14.9x |

| Enterprise | 13.9x | 14.5x | 15.2x |

| Environmental / CleanTech | 12.5x | 14.1x | 16x |

| Financial / Fintech | 12.3x | 14.5x | 15.5x |

| Healthcare / MedTech | 11.6x | 13.5x | 15.1x |

| Human Resources (HR) | 15.6x | 17.1x | 19.3x |

| Legal / Legal Tech | 10.8x | 11.5x | 12.8x |

| Real Estate / Proptech | 9.3x | 10.4x | 11.5x |

2025 SaaS Revenue Multiples – Private Sector

| Business Type | Revenue Range | ||

| $1-5M | $6-10M | $10-75M | |

| Advertising / AdTech | 4.5x | 5.6x | 7.1x |

| Agriculture / AgTech | 5.2x | 6.2x | 8.5x |

| Communication | 5.9x | 6.6x | 7.4x |

| Customer Relationship Management (CRM) | 5.7x | 7x | 8.2x |

| Cybersecurity | 6.1x | 6.9x | 8x |

| E-Commerce | 6.4x | 7.4x | 9.4x |

| Education / EdTech | 5.4x | 6.1x | 6.9x |

| Enterprise | 5.8x | 7.4x | 9.4x |

| Enterprise Resource Planning (ERP) | 6.6x | 8.1x | 9.6x |

| Environmental / CleanTech | 6.2x | 7.5x | 8.4x |

| Financial / FinTech | 5x | 5.5x | 7.7x |

| Healthcare / MedTech | 6.1x | 7.2x | 9.3x |

| Human Resources (HR) | 6.1x | 7.2x | 9.2x |

| Legal / LegalTech | 5.1x | 6.4x | 7.4x |

| Real Estate / PropTech | 5.4x | 6.8x | 8.2x |

2025 SaaS SDE Multiples – Private Sector

| Business Type | SDE Range | ||

| $500k-1M | $1M-2M | $2M-3M | |

| Advertising / AdTech | 6.2x | 7.5x | 8.4x |

| Agriculture / AgTech | 7x | 8.4x | 9.6x |

| Communication | 7.7x | 8.3x | 8.7x |

| Customer Relationship Management (CRM) | 7.6x | 8.3x | 8.9x |

| Cybersecurity | 7.5x | 8.4x | 9.5x |

| Education / EdTech | 6.3x | 7.3x | 8.4x |

| Environmental / CleanTech | 7.1x | 8.2x | 9.1x |

| E-Commerce | 7.1x | 8.6x | 9.4x |

| Enterprise | 7.8x | 8.8x | 10.5x |

| Enterprise Resource Planning (ERP) | 6.2x | 7x | 8.1x |

| Financial / Fintech | 7.6x | 8.4x | 9.2x |

| Healthcare / MedTech | 7.6x | 8.8x | 9.8x |

| Human Resources (HR) | 8x | 8.5x | 9.7x |

| Legal / LegalTech | 7.1x | 8.4x | 9x |

| Real Estate / PropTech | 6.6x | 7.9x | 9.1x |

The following sections provide further context to the data above by offering a high-level overview of the current M&A environment for private SaaS companies, as well as suggestions for how to sell a SaaS company in Q1 2025.

The 2025 M&A Market for SaaS Companies

Globally, the SaaS industry is valued at ~$273 billion in 2024, most of which are enterprises. the industry has experienced steady declines in CAGR 18.7% (Up from 18.4% in 2024), however it is nonetheless expected to more than triple by 2028, coming to a total of $720.4 billion. These numbers are on track with the industry’s historical expansion, having increased 7x over the last 10 years as more companies are seeking cloud-based services for their company.

SaaS CAGR, 2022-2025

As the economy slowly picks back up following the economic downturn that began in Q3 2022, SaaS companies are cautiously optimistic moving further into 2025. As of Q1 2024, industry reports cited SaaS revenue multiples slowly picking back from their three-year low of ~5.5x, which now sits closer to ~6.1x. There is still a long ways to go, however, until they hit the record high set in Q3 2021of 9.8x. This slow movement towards recovery reflects the trends in nearly all observed industries, as the volatility of an election year remains uncertain and the promise of lowering interest rates still loom in the near future.

Average EBITDA Multiples for SaaS Companies [Private], H1 2019 – H1 2025

As the economy recovers, SaaS company owners seeking to sell their company are contending with several challenges:

- Increased business-lending interest rates as a result of an uncertain market

- Massive sunk investments in company operations, leading to a difficulty in properly valuating the company’s worth

These factors contribute to the somewhat sparser M&A market of 2025. While deal volume and overall valuations are likely to pick up substantially in H2 2025 as interest rates continue to lower, PE firms and strategics have reported that business owners are increasingly negotiating the sale of their business through M&A advisors who are experienced with SaaS and technology.

Related: See our list of the Top M&A Advisory Firms in the US

Common SaaS Valuation Models

Valuations for SaaS companies can vary quite a bit because most are unprofitable in the early stages of growth as they invest in scaling. As a result, models that look at company earnings (ARR, YoY Growth Rate, Gross Margin) are preferable for sellers as opposed to those that look solely at EBITDA. In general, larger companies, i.e. those with >$25 million revenue, will want to emphasize EBITDA in an M&A process whereas smaller companies will want to suggest alternative valuation models that focus on projected growth.

Below is a comparison of the 3 most common valuation models for SaaS companies.

Common SaaS Valuation Models

| Model | Equation | Best For |

| EBITDA | Net Income + Interest + Taxes + Depreciation + Amortization | Established companies with $5M in annual recurring revenue or more |

| Seller’s Discretionary Earnings (SDE) | Total Revenue – (Operating Expenses/Cost of Goods Sold) –Owner Compensation | Smaller SaaS Companies making less than $5M in annual recurring revenue.SaaS companies with a single owner |

| Revenue | Sum of subscription revenue for the year + Recurring revenue from add-ons and upgrades | Private SaaS companies who have already been offered a valuation by a prospective buyer |

Non-Financial Factors Affecting SaaS Valuations

When going to market with a business, SaaS owners and investors should also be aware of the following non-financial factors that have a substantial affect on valuation.

Non-Financial Factors Affecting SaaS Valuations

| Factor | Significance to SaaS | Formula | SaaS Benchmark |

| Growth Rate | SaaS businesses that are able to handle the stresses of scaling are more likely to earn a higher valuation from the buyer. | Previous Year Value – Current ValuePrevious Year Value 100 | 7-8% |

| Future Proofing | SaaS is a fast-moving industry in which products often have a short shelf-life before they are replaced. | See our article on selling/valuing a SaaS company. | 11-15/25 |

| Cost to Replicate | The value of SaaS companies is in the proprietary nature of their software. If this software is easy to replicate, buyers have less reason to purchase their company. | # lines of codeX# months required to generate original code | Small: 25,000+Medium: 50,000+Large: 100,000+ |

Further Questions

I believe in bringing transparency to M&A, which is why we publish valuation multiples. If you have any questions, I’m happy to offer advice from the perspective of someone who has sold multiple companies to a variety of buyers. You can reach me using the address below or by using the contact page on this website.

Business – First Page Sage