Last Updated: January 7, 2025

Our analysts recently compiled data on private fintech M&A deals from Q4 2022 to Q1 2025 using private equity networks, expert interviews, and proprietary databases to determine accurate fintech valuation multiples in today’s environment. The valuation multiples are displayed in the tables below, and are further segmented by industry. (Sources)

Below, we present a table for both revenue multiples and EBITDA multiples. While both are common, revenue multiples are preferred in fintech M&A because of the high-growth, high-burn nature of these businesses.

Private Fintech Revenue Multiples – 2025

| Company Type | Revenue Range | ||

| $1-5M | $6-10M | $10-30M | |

| Accounting | 3.8x | 5.1x | 6x |

| Banking – Commercial | 4.2x | 5.7x | 6.7x |

| Banking – Consumer | 4.5x | 5.8x | 7x |

| Capital Raising | 4.3x | 6.2x | 7.1x |

| Cryptocurrency | 4.1x | 5.3x | 6.1x |

| Equity Financing | 4.6x | 5.5x | 6.4x |

| Insurance | 4.4x | 5.9x | 6.9x |

| Investing/Trading | 5.1x | 6.2x | 7.4x |

| Lending | 4.6x | 5.5x | 6.7x |

| Money Transfer | 4.8x | 5.8x | 6.5x |

| Payment Solutions | 5x | 5.6x | 6.7x |

| Regulatory | 3.9x | 5.2x | 6.1x |

| Wealth Management | 3.7x | 5.7x | 7x |

Private Fintech EBITDA Multiples – 2025

| Company Type | EBITDA Range | ||

| $1-3M | $3-5M | $5-10M | |

| Accounting | 11.4x | 13.1x | 14.5x |

| Banking – Commercial | 12.1x | 14.5x | 17.5x |

| Banking – Consumer | 11.5x | 13.1x | 15.2x |

| Capital Raising | 12.4x | 14.3x | 16.2x |

| Cryptocurrency | 9.7x | 11.6x | 14.1x |

| Equity Financing | 11.8x | 14.4x | 16.3x |

| Insurance | 10.8x | 12.9x | 14.2x |

| Investing/Trading | 12.5x | 15x | 16.6x |

| Lending | 12.2x | 15.1x | 16.4x |

| Money Transfer | 13.3x | 15.2x | 16.4x |

| Payment Solutions | 12.3x | 14.5x | 16.4x |

| Regulatory | 11x | 13x | 15.4x |

| Wealth Management | 14.8x | 15.6x | 17x |

The following sections provide further context to the data above, offering a high-level overview of the current M&A environment for fintech companies, as well as suggestions for how to sell a fintech company in 2025.

The 2025 M&A Market for Fintech Companies

Although the M&A market has experienced a decline in total deals in nearly every sector, fintech has been far less affected. Our research recorded over 600 private fintech deals between Q2 2022 and Q1 2025, this number nearly doubling pre-pandemic levels—which peaked at ~300 deals. Given the decline in the general M&A market that began in Q2 2022, a greater appetite for M&A (and corresponding level of liquidity) is evident within fintech.

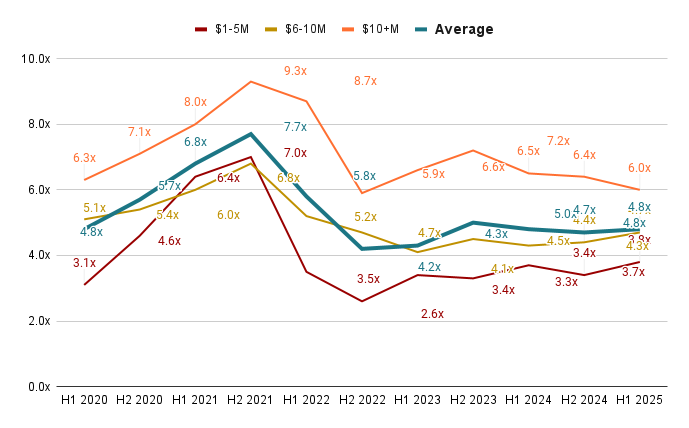

So far, however, deal volume and value has dropped noticeably in the last year. For example, the median revenue multiple range as of Q4 2024 was ~4.7x, which is ~26% lower than it was in 2021 at 7.7x. However, data trends show these multiples have experienced mild short-term increases following small cuts in the federal interest rate as of September 2024, which paints a cautiously optimistic picture of fintech M&A moving into 2025.

Revenue Multiples for Private Fintech Companies, 2020-2025

With these points in mind, our team has a few predictions for the rest of the year

- Fintech M&A will be a buyers market relatively soon. Sellers are more likely to find buyers but less likely to get a higher multiple than a few years ago, meaning buyers of all types are getting the most value out of fintech M&A transactions. (More about selling to PE firms vs. strategic buyers here.)

- Interest rate cuts may mean more favorable valuations. The Fed’s recent projection of a September 2024 rate cut, combined with a record-high amount of dry powder in the hands of private equity, will likely increase M&A activity across all sectors throughout 2025.

- PE is more likely to offer a higher multiple because a larger portion of their offer will be paid in equity. (More about the pros and cons of selling to private equity here.)

- Getting a higher multiple will require skill. Sellers without the time to spare will want to consider partnering with an M&A firm to secure the best possible deal at closing.

| Related: See our article on The Top M&A Advisory Firms – 2025 |

Selling a Fintech Company in 2025

Even experienced business owners can be overwhelmed with the process of selling their company. It’s an emotionally challenging experience by itself, made all the more difficult by the turbulence of the macroeconomic environment and the idiosyncrasies of dealmaking. I’ve sold multiple companies to both strategic acquirers and PE, and am happy to speak to any fellow entrepreneurs about the experience. You can contact me at the address listed below or through this website’s contact page.

Last Updated: January 7, 2025

Our analysts recently compiled data on private fintech M&A deals from Q4 2022 to Q1 2025 using private equity networks, expert interviews, and proprietary databases to determine accurate fintech valuation multiples in today’s environment. The valuation multiples are displayed in the tables below, and are further segmented by industry. (Sources)

Below, we present a table for both revenue multiples and EBITDA multiples. While both are common, revenue multiples are preferred in fintech M&A because of the high-growth, high-burn nature of these businesses.

Private Fintech Revenue Multiples – 2025

| Company Type | Revenue Range | ||

| $1-5M | $6-10M | $10-30M | |

| Accounting | 3.8x | 5.1x | 6x |

| Banking – Commercial | 4.2x | 5.7x | 6.7x |

| Banking – Consumer | 4.5x | 5.8x | 7x |

| Capital Raising | 4.3x | 6.2x | 7.1x |

| Cryptocurrency | 4.1x | 5.3x | 6.1x |

| Equity Financing | 4.6x | 5.5x | 6.4x |

| Insurance | 4.4x | 5.9x | 6.9x |

| Investing/Trading | 5.1x | 6.2x | 7.4x |

| Lending | 4.6x | 5.5x | 6.7x |

| Money Transfer | 4.8x | 5.8x | 6.5x |

| Payment Solutions | 5x | 5.6x | 6.7x |

| Regulatory | 3.9x | 5.2x | 6.1x |

| Wealth Management | 3.7x | 5.7x | 7x |

Private Fintech EBITDA Multiples – 2025

| Company Type | EBITDA Range | ||

| $1-3M | $3-5M | $5-10M | |

| Accounting | 11.4x | 13.1x | 14.5x |

| Banking – Commercial | 12.1x | 14.5x | 17.5x |

| Banking – Consumer | 11.5x | 13.1x | 15.2x |

| Capital Raising | 12.4x | 14.3x | 16.2x |

| Cryptocurrency | 9.7x | 11.6x | 14.1x |

| Equity Financing | 11.8x | 14.4x | 16.3x |

| Insurance | 10.8x | 12.9x | 14.2x |

| Investing/Trading | 12.5x | 15x | 16.6x |

| Lending | 12.2x | 15.1x | 16.4x |

| Money Transfer | 13.3x | 15.2x | 16.4x |

| Payment Solutions | 12.3x | 14.5x | 16.4x |

| Regulatory | 11x | 13x | 15.4x |

| Wealth Management | 14.8x | 15.6x | 17x |

The following sections provide further context to the data above, offering a high-level overview of the current M&A environment for fintech companies, as well as suggestions for how to sell a fintech company in 2025.

The 2025 M&A Market for Fintech Companies

Although the M&A market has experienced a decline in total deals in nearly every sector, fintech has been far less affected. Our research recorded over 600 private fintech deals between Q2 2022 and Q1 2025, this number nearly doubling pre-pandemic levels—which peaked at ~300 deals. Given the decline in the general M&A market that began in Q2 2022, a greater appetite for M&A (and corresponding level of liquidity) is evident within fintech.

So far, however, deal volume and value has dropped noticeably in the last year. For example, the median revenue multiple range as of Q4 2024 was ~4.7x, which is ~26% lower than it was in 2021 at 7.7x. However, data trends show these multiples have experienced mild short-term increases following small cuts in the federal interest rate as of September 2024, which paints a cautiously optimistic picture of fintech M&A moving into 2025.

Revenue Multiples for Private Fintech Companies, 2020-2025

With these points in mind, our team has a few predictions for the rest of the year

- Fintech M&A will be a buyers market relatively soon. Sellers are more likely to find buyers but less likely to get a higher multiple than a few years ago, meaning buyers of all types are getting the most value out of fintech M&A transactions. (More about selling to PE firms vs. strategic buyers here.)

- Interest rate cuts may mean more favorable valuations. The Fed’s recent projection of a September 2024 rate cut, combined with a record-high amount of dry powder in the hands of private equity, will likely increase M&A activity across all sectors throughout 2025.

- PE is more likely to offer a higher multiple because a larger portion of their offer will be paid in equity. (More about the pros and cons of selling to private equity here.)

- Getting a higher multiple will require skill. Sellers without the time to spare will want to consider partnering with an M&A firm to secure the best possible deal at closing.

| Related: See our article on The Top M&A Advisory Firms – 2025 |

Selling a Fintech Company in 2025

Even experienced business owners can be overwhelmed with the process of selling their company. It’s an emotionally challenging experience by itself, made all the more difficult by the turbulence of the macroeconomic environment and the idiosyncrasies of dealmaking. I’ve sold multiple companies to both strategic acquirers and PE, and am happy to speak to any fellow entrepreneurs about the experience. You can contact me at the address listed below or through this website’s contact page.

Business – First Page Sage