Last Updated: February 6, 2025

This report provides average EBITDA and revenue multiples being paid for private healthcare companies in 2025. Our analysts sourced data from third-party M&A databases, private equity networks, and interviews with M&A professionals between Q1 2022 and Q1 2025. (Sources)

The tables below break down EBITDA multiples by healthcare subsector as well as EBITDA/Revenue range.

EBITDA Multiples for Private Healthcare Companies, 2025 |

|||

| Subsector | EBITDA Range | ||

| $1-3M | $3-5M | $5-10M | |

| Addiction Treatment | 4.1x | 5.5x | 6.8x |

| Dermatology | 5.4x | 7.3x | 8.3x |

| Hospitals | 6.3x | 8.2x | 9.7x |

| Medical Device | 6.7x | 8.3x | 10.4x |

| Medical Practices | 5.6x | 7.1x | 8.8x |

| Medtech | 6.2x | 7.2x | 8.4x |

| Plastic Surgery | 7.3x | 9.7x | 11.3x |

| Senior Living | 4.7x | 6.2x | 7.4x |

Revenue Multiples for Private Healthcare Companies, 2025 |

|||

| Subsector | Revenue Range | ||

| $1-5M | $6-10M | $10-50M | |

| Addiction Treatment | 1.3x | 2x | 2.5x |

| Dermatology | 2.2x | 3.1x | 3.5x |

| Hospitals | 4.5x | 5.9x | 6.7x |

| Medical Device | 3.6x | 4.4x | 5x |

| Medical Practices | 2.6x | 3.3x | 4.1x |

| Medtech | 3.2x | 4x | 4.6x |

| Plastic Surgery | 4.4x | 5.1x | 6x |

| Senior Living | 2x | 2.5x | 2.9x |

During the research period, our analysts made the following observations about the current healthcare M&A market:

- The subsectors with the highest multiples were non-essential healthcare companies: plastic surgery and medical devices. However, those industries have seen more inconsistency in valuations over time, rising and falling with major economic indicators. (See next section.)

- The subsectors with the lowest multiples – but greater long-term stability in valuations – were addiction treatment and senior living, which tend to be viewed as slower growth businesses tied to physical real estate.

- On average, companies represented by M&A advisors or investment banks saw a 23% higher multiple from buyers.

| Related: See our report on the Top M&A firms in the U.S. |

Below, our analysts provide greater context for these multiples, focusing on the ways in which private equity firms and strategic buyers are viewing healthcare businesses today.

The State of Healthcare M&A in 2025

Unlike other industries which saw declines from the macroeconomic turbulence of H2 2022, healthcare saw only minor losses—making it one of the highest performing sectors during the last year. There was a notable disparity in valuation between essential vs. non-essential healthcare companies. More stable subsectors like hospitals weathered the storm remarkably well, experiencing an ~7% reduction in EBITDA multiples, from 8.5x to 7.9x, while less essential healthcare specialties like plastic surgery experienced a more severe decline of ~20% in the same time span, from 11x to 8.8x.

While 2022 was a record year in healthcare M&A, deal volume slowed a bit in 2023, dropping 17% between Q3 2022 and Q3 2023. However, despite the decline in deal volume, multiples were climbing their way back up to 2021 levels, painting a picture of a 2024 M&A environment in which buyers are pickier about transactions, but willing to pay higher amounts.

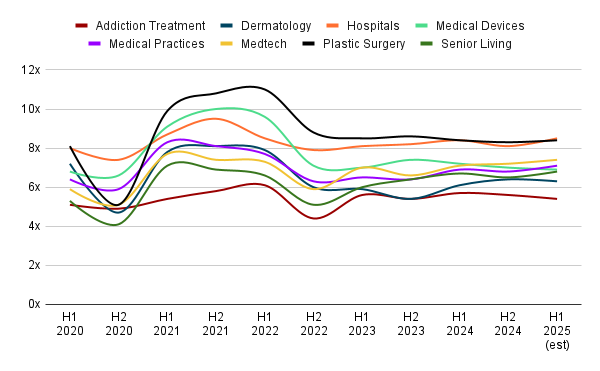

EBITDA Multiples for Private Healthcare Companies, 2020-2025

As of Q1 2025, rising drug costs and a tight labor market have made healthcare companies more of a risk for prospective buyers who saw the industry as a more stable investment just earlier this year. While the surge in AI is expected to help lower these costs by cutting operational spending, larger transformations within the industry (e.g., telehealth & virtual care services, robotic surgery) will likely see more favorable valuations as we move further into 2025.

Here are some of our analysts’ predictions for the coming year in healthcare M&A:

Essential Healthcare Will Become a Priority

Essential healthcare businesses such as hospitals and private practices should see an uptick in their multiples, given that the health of our population isn’t improving at the current time. Buyers in the current M&A market prefer to acquire businesses that have less downside, even if the upside isn’t as high. While non-essential healthcare specialties such as plastic surgery and dermatology are currently seeing higher multiples, we expect them to decline some until the economy restabilizes.

Deal Volume Will Rise

Because of the economic downturn in H2 2022, many buyers chose to hold off on purchasing decisions until they were able to get a better sense of the macroeconomic outcome. As a result, there has been a great deal of dry powder in the hands of buyers which has not yet been deployed. As the economy improves, we expect this dry powder will be used quickly as buyers attempt to grow their businesses.

Private Equity Will Focus on Middle Market Companies

With the margins for error being as high as they are due to economic uncertainty, private equity companies are more likely to prioritize the purchase and sale of smaller portfolio companies due to the greater amount of profit which can be extracted from their eventual sale. Activity amongst these buyers saw a slight decline at the end of 2022, but came back during 2024, indicating an intent to capitalize on the existing stability while it lasts.

Selling Your Healthcare Company

Selling a healthcare company is a complex and challenging process. As someone who’s sold several companies to both private equity and strategic buyers, I can speak to many of these challenges personally. During the process of selling, I became a big believer in transparency in M&A. If you have any questions, feel free to reach out and I’m happy to offer a few minutes of my time. You can reach me via the contact page of this website or using the link below.

Sources:

- Healthcare M&A Report (VMG Health)

- Healthcare Services Valuation Update (Workweek)

- Healthcare M&A Outlook (HealthCare Appriasers)

- Full Year Healthcare Industry Trends (Berkery Noyes)

- Health & Wellness Valuation Multiples (Finerva)

- HEALTHCARE INDUSTRY UPDATE (Greenwich Capital Group)

- Healthcare M&A activity predicted to continue (Grant Thornton)

- Evaluating The Healthcare M&A Market (Focus Search Partners)

Last Updated: February 6, 2025

This report provides average EBITDA and revenue multiples being paid for private healthcare companies in 2025. Our analysts sourced data from third-party M&A databases, private equity networks, and interviews with M&A professionals between Q1 2022 and Q1 2025. (Sources)

The tables below break down EBITDA multiples by healthcare subsector as well as EBITDA/Revenue range.

EBITDA Multiples for Private Healthcare Companies, 2025 |

|||

| Subsector | EBITDA Range | ||

| $1-3M | $3-5M | $5-10M | |

| Addiction Treatment | 4.1x | 5.5x | 6.8x |

| Dermatology | 5.4x | 7.3x | 8.3x |

| Hospitals | 6.3x | 8.2x | 9.7x |

| Medical Device | 6.7x | 8.3x | 10.4x |

| Medical Practices | 5.6x | 7.1x | 8.8x |

| Medtech | 6.2x | 7.2x | 8.4x |

| Plastic Surgery | 7.3x | 9.7x | 11.3x |

| Senior Living | 4.7x | 6.2x | 7.4x |

Revenue Multiples for Private Healthcare Companies, 2025 |

|||

| Subsector | Revenue Range | ||

| $1-5M | $6-10M | $10-50M | |

| Addiction Treatment | 1.3x | 2x | 2.5x |

| Dermatology | 2.2x | 3.1x | 3.5x |

| Hospitals | 4.5x | 5.9x | 6.7x |

| Medical Device | 3.6x | 4.4x | 5x |

| Medical Practices | 2.6x | 3.3x | 4.1x |

| Medtech | 3.2x | 4x | 4.6x |

| Plastic Surgery | 4.4x | 5.1x | 6x |

| Senior Living | 2x | 2.5x | 2.9x |

During the research period, our analysts made the following observations about the current healthcare M&A market:

- The subsectors with the highest multiples were non-essential healthcare companies: plastic surgery and medical devices. However, those industries have seen more inconsistency in valuations over time, rising and falling with major economic indicators. (See next section.)

- The subsectors with the lowest multiples – but greater long-term stability in valuations – were addiction treatment and senior living, which tend to be viewed as slower growth businesses tied to physical real estate.

- On average, companies represented by M&A advisors or investment banks saw a 23% higher multiple from buyers.

| Related: See our report on the Top M&A firms in the U.S. |

Below, our analysts provide greater context for these multiples, focusing on the ways in which private equity firms and strategic buyers are viewing healthcare businesses today.

The State of Healthcare M&A in 2025

Unlike other industries which saw declines from the macroeconomic turbulence of H2 2022, healthcare saw only minor losses—making it one of the highest performing sectors during the last year. There was a notable disparity in valuation between essential vs. non-essential healthcare companies. More stable subsectors like hospitals weathered the storm remarkably well, experiencing an ~7% reduction in EBITDA multiples, from 8.5x to 7.9x, while less essential healthcare specialties like plastic surgery experienced a more severe decline of ~20% in the same time span, from 11x to 8.8x.

While 2022 was a record year in healthcare M&A, deal volume slowed a bit in 2023, dropping 17% between Q3 2022 and Q3 2023. However, despite the decline in deal volume, multiples were climbing their way back up to 2021 levels, painting a picture of a 2024 M&A environment in which buyers are pickier about transactions, but willing to pay higher amounts.

EBITDA Multiples for Private Healthcare Companies, 2020-2025

As of Q1 2025, rising drug costs and a tight labor market have made healthcare companies more of a risk for prospective buyers who saw the industry as a more stable investment just earlier this year. While the surge in AI is expected to help lower these costs by cutting operational spending, larger transformations within the industry (e.g., telehealth & virtual care services, robotic surgery) will likely see more favorable valuations as we move further into 2025.

Here are some of our analysts’ predictions for the coming year in healthcare M&A:

Essential Healthcare Will Become a Priority

Essential healthcare businesses such as hospitals and private practices should see an uptick in their multiples, given that the health of our population isn’t improving at the current time. Buyers in the current M&A market prefer to acquire businesses that have less downside, even if the upside isn’t as high. While non-essential healthcare specialties such as plastic surgery and dermatology are currently seeing higher multiples, we expect them to decline some until the economy restabilizes.

Deal Volume Will Rise

Because of the economic downturn in H2 2022, many buyers chose to hold off on purchasing decisions until they were able to get a better sense of the macroeconomic outcome. As a result, there has been a great deal of dry powder in the hands of buyers which has not yet been deployed. As the economy improves, we expect this dry powder will be used quickly as buyers attempt to grow their businesses.

Private Equity Will Focus on Middle Market Companies

With the margins for error being as high as they are due to economic uncertainty, private equity companies are more likely to prioritize the purchase and sale of smaller portfolio companies due to the greater amount of profit which can be extracted from their eventual sale. Activity amongst these buyers saw a slight decline at the end of 2022, but came back during 2024, indicating an intent to capitalize on the existing stability while it lasts.

Selling Your Healthcare Company

Selling a healthcare company is a complex and challenging process. As someone who’s sold several companies to both private equity and strategic buyers, I can speak to many of these challenges personally. During the process of selling, I became a big believer in transparency in M&A. If you have any questions, feel free to reach out and I’m happy to offer a few minutes of my time. You can reach me via the contact page of this website or using the link below.

Sources:

- Healthcare M&A Report (VMG Health)

- Healthcare Services Valuation Update (Workweek)

- Healthcare M&A Outlook (HealthCare Appriasers)

- Full Year Healthcare Industry Trends (Berkery Noyes)

- Health & Wellness Valuation Multiples (Finerva)

- HEALTHCARE INDUSTRY UPDATE (Greenwich Capital Group)

- Healthcare M&A activity predicted to continue (Grant Thornton)

- Evaluating The Healthcare M&A Market (Focus Search Partners)

Business – First Page Sage