Last Updated: February 6, 2025

This report features average EBITDA and revenue multiples for private manufacturing companies in 2025. Our analysts sourced this data from private equity networks, third-party M&A databases, and interviews with M&A professionals between Q3 2023 – Q1 2025. (Sources)

The tables below break down manufacturing EBITDA and valuation multiples by company type and EBITDA/Revenue range.

Manufacturing EBITDA Multiples [Private Sector] Q3 2023 – Q1 2025 |

|||

| Company Type | EBITDA Range | ||

| $1-3M | $3-5M | $5-10M | |

| Aerospace | 7.4x | 9x | 10.9x |

| Automotive | 7x | 8.7x | 10.2x |

| Consumer Products | 6.9x | 8.2x | 9.1x |

| Food & Beverage | 8.1x | 8.6x | 9.4x |

| Industrial IoT | 7.4x | 8.9x | 11x |

| Marine & Maritime | 6.8x | 8.3x | 9.1x |

| Recycling & Waste Management | 7.1x | 9.3x | 11.1x |

| Transportation & Logistics | 7.2x | 9.2x | 10.3x |

Manufacturing Revenue Multiples [Private Sector] Q3 2023 – Q1 2025 |

|||

| Company Type | Revenue Range | ||

| $3-5M | $5-10M | $10-50M | |

| Aerospace | 2.7x | 3.6x | 4.3x |

| Automotive | 2.1x | 3x | 3.8x |

| Consumer Products | 2.5x | 3.3x | 4.2x |

| Food & Beverage | 2.6x | 3.5x | 4.1x |

| Industrial IoT | 2.7x | 3.6x | 4.2x |

| Marine & Maritime | 2x | 3.3x | 3.6x |

| Recycling & Waste Management | 2.6x | 3.7x | 4.3x |

| Transportation & Logistics | 2.8x | 4.1x | 4.6x |

In the following sections, we explain how manufacturing companies were valued by acquirers. We also discuss the state of manufacturing M&A in 2025, identifying trends that our analysts believe will impact this M&A marketplace in the future.

How Manufacturing Companies are Valued

Manufacturing is a capital intensive industry involving assets like factories, machinery, and equipment, which companies often take on debt to acquire. Thus, private manufacturing companies are typically valued using a multiple of EBITDA as well as a debt-to-EBITDA ratio to get a clear picture of cash flow.

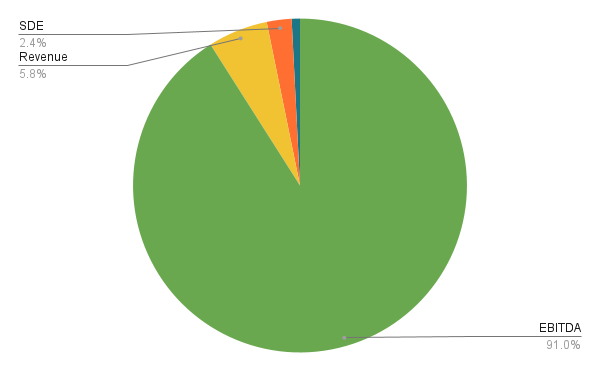

Manufacturing M&A Deals by Valuation Method (2025)

As the graph above illustrates, a small percentage of deals were conducted using revenue/SDE multiples. These methods are often used to value manufacturing companies that are less capital intensive (e.g. 3D printing, small textile manufacturers).

In addition to EBITDA and debt-to-EBITDA ratio, M&A buyers in the deals assessed also paid attention to specific performance metrics for manufacturing companies. Based on the data, we found that manufacturing companies were more likely to sell for higher multiples if they met the following benchmarks:

M&A Metrics for Private Manufacturing Companies |

||

| Name | Equation | Benchmark |

| Debt to EBITDA Ratio |  |

≥3:1 |

| Maintenance to Total Expenses | Cost of repairing broken machinery over a period of time vs Total Expenses |

15%-40% |

| Inventory Turnover Ratio |  |

5:1 – 10:1 |

| Return on Net Assets |  |

5% – 20%+ |

| Manufacturing Costs to Expenses | Total cost of production vs Total Expenses |

≥42% |

Manufacturing company valuations also varied substantially based on the seller’s representation or lack thereof; companies that opted to run their own M&A process earned, on average, 31% less from their deal than companies that ran the same process through an M&A advisory firm or investment bank.

The State of Manufacturing M&A in 2025

While the private sector manufacturing M&A market saw a substantial dip in 2022 and 2023, 2024 and 2025 have (so far) proven brighter. There was an ~9% increase in the valuation multiple offered by buyers, from 10.2x to 11.1x, from H1 2024 to H1 2025. The average deal value within the sector also rose substantially, more than doubling in 6 months. Based on this trajectory, our analysts predict average deal value to be three times what it was at the start of 2023 by Q2 2024.

M&A Activity by Value & EBITDA Multiple

When compared to 2023, which saw a decline in deal numbers from 754 to 661, 2024 saw a rise. 2025 has is projected to continue this trend, albeit modestly, with deal numbers that may even exceed the frothy numbers we saw in 2021. Observing that total deal value in 2024 was lower than it was in 2021, we can conclude that average deal size was lower in 2024 vs 2021 despite the number of deals being similar.

Manufacturing M&A: Deal Numbers, 2019-2025

Despite the increases in # of deals and valuation multiples in 2024, manufacturing is still recovering from a longer downturn which started with the pandemic, in which output fell by 43%, according to the U.S. Bureau of Labor Statistics due to quarantines and subsequent supply chain disruptions.

Given this context, our analysts made the following predictions for manufacturing M&A in the coming 12-24 months:

- The manufacturing industry will continue to make modest increases in value and multiples: The recent dip in deal value, volume, and multiples is due to economic uncertainty when interest rates still hadn’t declined. As this uncertainty resolves in a relatively lower interest rate environment, manufacturing will continue to see steady increases in all three.

- Data accuracy will equate to higher multiples: Buyers want to know how capital intensive a manufacturing business is, so it’s in sellers’ best interest to have this information readily available. Similarly, it’s important to be able to articulate, with numbers, where a business stands compared to its competitors.

- Alternative deal types will be more common: The 2022-2023 macroeconomic climate has made buyers in several industries uncertain about the prospect of traditional M&A activity, causing joint ventures and strategic partnerships to be more prevalent. Sellers willing to consider these options are likely to have an easier time selling for a higher multiple.

Selling Your Manufacturing Company in 2025

The process of selling any business is overwhelming, but the myriad of logistical concerns surrounding manufacturing companies makes it especially daunting. For those seeking advice, I am happy to answer your questions as I’ve gone through this process several times before and am a big believer in transparency in M&A. You can reach me via the link below or through the contact page on this website.

Sources:

- Capital Expenditures by Sector (US) (NYU)

- M&A Statistics by Industries (IMAA)

- EBITDA Multiples for Manufacturing Companies (MicroCap)

- EBITDA Multiple for Manufacturing Companies Simplified (Rogerson Business Services)

- Manufacturing Industries Valuation Multiples (BMI)

Last Updated: February 6, 2025

This report features average EBITDA and revenue multiples for private manufacturing companies in 2025. Our analysts sourced this data from private equity networks, third-party M&A databases, and interviews with M&A professionals between Q3 2023 – Q1 2025. (Sources)

The tables below break down manufacturing EBITDA and valuation multiples by company type and EBITDA/Revenue range.

Manufacturing EBITDA Multiples [Private Sector] Q3 2023 – Q1 2025 |

|||

| Company Type | EBITDA Range | ||

| $1-3M | $3-5M | $5-10M | |

| Aerospace | 7.4x | 9x | 10.9x |

| Automotive | 7x | 8.7x | 10.2x |

| Consumer Products | 6.9x | 8.2x | 9.1x |

| Food & Beverage | 8.1x | 8.6x | 9.4x |

| Industrial IoT | 7.4x | 8.9x | 11x |

| Marine & Maritime | 6.8x | 8.3x | 9.1x |

| Recycling & Waste Management | 7.1x | 9.3x | 11.1x |

| Transportation & Logistics | 7.2x | 9.2x | 10.3x |

Manufacturing Revenue Multiples [Private Sector] Q3 2023 – Q1 2025 |

|||

| Company Type | Revenue Range | ||

| $3-5M | $5-10M | $10-50M | |

| Aerospace | 2.7x | 3.6x | 4.3x |

| Automotive | 2.1x | 3x | 3.8x |

| Consumer Products | 2.5x | 3.3x | 4.2x |

| Food & Beverage | 2.6x | 3.5x | 4.1x |

| Industrial IoT | 2.7x | 3.6x | 4.2x |

| Marine & Maritime | 2x | 3.3x | 3.6x |

| Recycling & Waste Management | 2.6x | 3.7x | 4.3x |

| Transportation & Logistics | 2.8x | 4.1x | 4.6x |

In the following sections, we explain how manufacturing companies were valued by acquirers. We also discuss the state of manufacturing M&A in 2025, identifying trends that our analysts believe will impact this M&A marketplace in the future.

How Manufacturing Companies are Valued

Manufacturing is a capital intensive industry involving assets like factories, machinery, and equipment, which companies often take on debt to acquire. Thus, private manufacturing companies are typically valued using a multiple of EBITDA as well as a debt-to-EBITDA ratio to get a clear picture of cash flow.

Manufacturing M&A Deals by Valuation Method (2025)

As the graph above illustrates, a small percentage of deals were conducted using revenue/SDE multiples. These methods are often used to value manufacturing companies that are less capital intensive (e.g. 3D printing, small textile manufacturers).

In addition to EBITDA and debt-to-EBITDA ratio, M&A buyers in the deals assessed also paid attention to specific performance metrics for manufacturing companies. Based on the data, we found that manufacturing companies were more likely to sell for higher multiples if they met the following benchmarks:

M&A Metrics for Private Manufacturing Companies |

||

| Name | Equation | Benchmark |

| Debt to EBITDA Ratio |  |

≥3:1 |

| Maintenance to Total Expenses | Cost of repairing broken machinery over a period of time vs Total Expenses |

15%-40% |

| Inventory Turnover Ratio |  |

5:1 – 10:1 |

| Return on Net Assets |  |

5% – 20%+ |

| Manufacturing Costs to Expenses | Total cost of production vs Total Expenses |

≥42% |

Manufacturing company valuations also varied substantially based on the seller’s representation or lack thereof; companies that opted to run their own M&A process earned, on average, 31% less from their deal than companies that ran the same process through an M&A advisory firm or investment bank.

The State of Manufacturing M&A in 2025

While the private sector manufacturing M&A market saw a substantial dip in 2022 and 2023, 2024 and 2025 have (so far) proven brighter. There was an ~9% increase in the valuation multiple offered by buyers, from 10.2x to 11.1x, from H1 2024 to H1 2025. The average deal value within the sector also rose substantially, more than doubling in 6 months. Based on this trajectory, our analysts predict average deal value to be three times what it was at the start of 2023 by Q2 2024.

M&A Activity by Value & EBITDA Multiple

When compared to 2023, which saw a decline in deal numbers from 754 to 661, 2024 saw a rise. 2025 has is projected to continue this trend, albeit modestly, with deal numbers that may even exceed the frothy numbers we saw in 2021. Observing that total deal value in 2024 was lower than it was in 2021, we can conclude that average deal size was lower in 2024 vs 2021 despite the number of deals being similar.

Manufacturing M&A: Deal Numbers, 2019-2025

Despite the increases in # of deals and valuation multiples in 2024, manufacturing is still recovering from a longer downturn which started with the pandemic, in which output fell by 43%, according to the U.S. Bureau of Labor Statistics due to quarantines and subsequent supply chain disruptions.

Given this context, our analysts made the following predictions for manufacturing M&A in the coming 12-24 months:

- The manufacturing industry will continue to make modest increases in value and multiples: The recent dip in deal value, volume, and multiples is due to economic uncertainty when interest rates still hadn’t declined. As this uncertainty resolves in a relatively lower interest rate environment, manufacturing will continue to see steady increases in all three.

- Data accuracy will equate to higher multiples: Buyers want to know how capital intensive a manufacturing business is, so it’s in sellers’ best interest to have this information readily available. Similarly, it’s important to be able to articulate, with numbers, where a business stands compared to its competitors.

- Alternative deal types will be more common: The 2022-2023 macroeconomic climate has made buyers in several industries uncertain about the prospect of traditional M&A activity, causing joint ventures and strategic partnerships to be more prevalent. Sellers willing to consider these options are likely to have an easier time selling for a higher multiple.

Selling Your Manufacturing Company in 2025

The process of selling any business is overwhelming, but the myriad of logistical concerns surrounding manufacturing companies makes it especially daunting. For those seeking advice, I am happy to answer your questions as I’ve gone through this process several times before and am a big believer in transparency in M&A. You can reach me via the link below or through the contact page on this website.

Sources:

- Capital Expenditures by Sector (US) (NYU)

- M&A Statistics by Industries (IMAA)

- EBITDA Multiples for Manufacturing Companies (MicroCap)

- EBITDA Multiple for Manufacturing Companies Simplified (Rogerson Business Services)

- Manufacturing Industries Valuation Multiples (BMI)

Business – First Page Sage