Last Updated: January 22, 2025

The valuation multiple tables below reflect data collected by our analysts between H2 2022 and H1 2025 on private company M&A transactions within the tech sector. They contain average EBITDA and revenue multiples for tech companies within 9 industries, which we further subdivide by EBITDA or revenue range. Our dataset was built from an amalgam of paid private equity databases and proprietary deal records from M&A professionals. (Sources)

EBITDA Multiples for Private Tech Companies, H1 2025 |

|||

| Industry | EBITDA Range | ||

| $1-$3M | $3-$5M | $5-$10M | |

| Adtech | 7.4x | 9.1x | 10.7x |

| Agtech | 8.3x | 10.4x | 11.5x |

| B2B SaaS | 9x | 11x | 12.4x |

| Cybersecurity | 9.1x | 11.5x | 12.5x |

| Fintech | 9.8x | 12.1x | 12.3x |

| Hosting | 7.5x | 9.1x | 11.6x |

| Managed Services | 8.2x | 9.8x | 10.8x |

| SaaS | 8.7x | 11.1x | 12.4x |

| Semiconductors | 9.4x | 11.3x | 12.8x |

| Software Development | 8.6x | 10.1x | 12x |

Revenue Multiples for Private Tech Companies, H1 2025 |

|||

| Industry | Revenue Range | ||

| $1-$5M | $6-$10M | $10-$75M | |

| Adtech | 2x | 2.4x | 2.7x |

| Agtech | 2.2x | 2.7x | 3.2x |

| B2B SaaS | 2.3x | 3.1x | 3.2x |

| Cybersecurity | 2.6x | 3x | 3.2x |

| Fintech | 2.7x | 2.8x | 3.2x |

| Hosting | 1.4x | 2.1x | 2.5x |

| Managed Services | 2.2x | 2.6x | 2.8x |

| SaaS | 2.2x | 2.8x | 3.4x |

| Semiconductors | 2.5x | 3.4x | 3.4x |

| Software Development | 2x | 2.6x | 3.4x |

The following sections provide context for the multiples listed above by discussing the current state of tech M&A, as well as common factors affecting the valuation of tech companies.

The State of Tech M&A in 2025

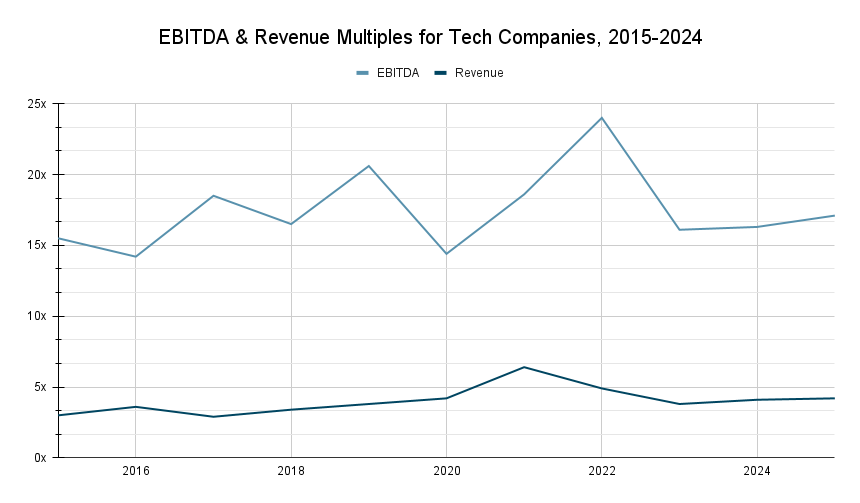

Until recently, the tech industry was thought of as a reliable field in which to invest due to the steady YoY growth it experienced in 2010s. With the onset of the pandemic in 2020, these multiples rapidly rose, largely due to the growing need for tech solutions in the face of work-from-home mandates. When the economic downturn started in H2 2022, these multiples fell, as many tech companies couldn’t produce value at the scale of their projected worth.

Tech has gone through something of a reckoning in M&A. Prior to 2022, sellers made great use of revenue multiples to mask heavy sunken costs. This tactic earned many tech companies a higher payout in times of higher M&A activity, however contemporary buyers have grown more stringent in their acquisition choices, demanding a clear path to profitability before considering a purchase.

Despite these overall considerations, the future impact of tech companies is undeniable. With an expected industry CAGR of 9.7%, tech fields are expected to grow into a conglomerated industry worth over $600b by 2030, with overall growth being led by fast-growing sectors like business intelligence and customer analytics.

Predictions

Based on our read of the market, our research team has the following assumptions about the future of the tech industry:

- Deal volume is likely to increase as interest rates lower. Despite tech companies having exceptionally high valuations as of Q1 2025, many buyers are nonetheless hesitant to acquire companies when the cost of borrowing money is as high as it is (SOFR sits at 4.5% as of Q1 2025). As rates continue to lower following the initial cut in September 2024, we predict these buyers will re-enter the buyers pool, resulting in a sizeable bump in M&A deal volume in 2025.

- EBITDA will likely regain its original prominence, with investors having previously relied too heavily on revenue multiples that do not indicate a company’s profitability.

- PE Firms & Strategics will favor smaller tech companies, as the weaker market will tempt buyers to save cash and put more sweat equity into deals, rehabbing businesses over time.

Factors Affecting Multiples

With publicly-available deal information available for approximately 392 deals in 2024, our research team identified not only the valuation multiple averages listed above, but also the criteria upon which those multiples were earned.

The table below identifies these criteria, as well as an approximated weight for each. This weight was determined by the overall impact their absence or presence appears to have had on offers made.

Valuation Factors For Tech Companies, Weighted |

||

| Factor | Description | Weight |

| Cash Flow | Profit sustained over at least a 24 month period | 45% |

| Company Size & Age | An established infrastructure, base of operations, and labor force, sustained over multiple years | 30% |

| Owner Dependency | The ability to replace the owner after a 12-36 month earnout | 15% |

| Customer Base | A growing customer base with high loyalty and low churn | 10% |

It should be noted that additional factors (e.g. geography, specialization) were factored into a company’s valuation. The difference between these smaller examples and the four listed above is that the examples on the table were noted in more than 90% of deals listed, indicating a greater reliance on them on the part of buyers in both PE firms and strategics.

Selling a Tech Company

Anyone who has sold a company before will tell you that it’s a complicated experience, regardless of the seller, industry, or EBITDA range. Despite the lowering of interest rates in mid-2024, the turbulence of the last two years continues to give many buyers pause before committing to a purchase.

I have sold several tech companies myself and am happy to offer advice from a neutral, third-party perspective. You can reach me via the link below or through the contact page on this website.

Last Updated: January 22, 2025

The valuation multiple tables below reflect data collected by our analysts between H2 2022 and H1 2025 on private company M&A transactions within the tech sector. They contain average EBITDA and revenue multiples for tech companies within 9 industries, which we further subdivide by EBITDA or revenue range. Our dataset was built from an amalgam of paid private equity databases and proprietary deal records from M&A professionals. (Sources)

EBITDA Multiples for Private Tech Companies, H1 2025 |

|||

| Industry | EBITDA Range | ||

| $1-$3M | $3-$5M | $5-$10M | |

| Adtech | 7.4x | 9.1x | 10.7x |

| Agtech | 8.3x | 10.4x | 11.5x |

| B2B SaaS | 9x | 11x | 12.4x |

| Cybersecurity | 9.1x | 11.5x | 12.5x |

| Fintech | 9.8x | 12.1x | 12.3x |

| Hosting | 7.5x | 9.1x | 11.6x |

| Managed Services | 8.2x | 9.8x | 10.8x |

| SaaS | 8.7x | 11.1x | 12.4x |

| Semiconductors | 9.4x | 11.3x | 12.8x |

| Software Development | 8.6x | 10.1x | 12x |

Revenue Multiples for Private Tech Companies, H1 2025 |

|||

| Industry | Revenue Range | ||

| $1-$5M | $6-$10M | $10-$75M | |

| Adtech | 2x | 2.4x | 2.7x |

| Agtech | 2.2x | 2.7x | 3.2x |

| B2B SaaS | 2.3x | 3.1x | 3.2x |

| Cybersecurity | 2.6x | 3x | 3.2x |

| Fintech | 2.7x | 2.8x | 3.2x |

| Hosting | 1.4x | 2.1x | 2.5x |

| Managed Services | 2.2x | 2.6x | 2.8x |

| SaaS | 2.2x | 2.8x | 3.4x |

| Semiconductors | 2.5x | 3.4x | 3.4x |

| Software Development | 2x | 2.6x | 3.4x |

The following sections provide context for the multiples listed above by discussing the current state of tech M&A, as well as common factors affecting the valuation of tech companies.

The State of Tech M&A in 2025

Until recently, the tech industry was thought of as a reliable field in which to invest due to the steady YoY growth it experienced in 2010s. With the onset of the pandemic in 2020, these multiples rapidly rose, largely due to the growing need for tech solutions in the face of work-from-home mandates. When the economic downturn started in H2 2022, these multiples fell, as many tech companies couldn’t produce value at the scale of their projected worth.

Tech has gone through something of a reckoning in M&A. Prior to 2022, sellers made great use of revenue multiples to mask heavy sunken costs. This tactic earned many tech companies a higher payout in times of higher M&A activity, however contemporary buyers have grown more stringent in their acquisition choices, demanding a clear path to profitability before considering a purchase.

Despite these overall considerations, the future impact of tech companies is undeniable. With an expected industry CAGR of 9.7%, tech fields are expected to grow into a conglomerated industry worth over $600b by 2030, with overall growth being led by fast-growing sectors like business intelligence and customer analytics.

Predictions

Based on our read of the market, our research team has the following assumptions about the future of the tech industry:

- Deal volume is likely to increase as interest rates lower. Despite tech companies having exceptionally high valuations as of Q1 2025, many buyers are nonetheless hesitant to acquire companies when the cost of borrowing money is as high as it is (SOFR sits at 4.5% as of Q1 2025). As rates continue to lower following the initial cut in September 2024, we predict these buyers will re-enter the buyers pool, resulting in a sizeable bump in M&A deal volume in 2025.

- EBITDA will likely regain its original prominence, with investors having previously relied too heavily on revenue multiples that do not indicate a company’s profitability.

- PE Firms & Strategics will favor smaller tech companies, as the weaker market will tempt buyers to save cash and put more sweat equity into deals, rehabbing businesses over time.

Factors Affecting Multiples

With publicly-available deal information available for approximately 392 deals in 2024, our research team identified not only the valuation multiple averages listed above, but also the criteria upon which those multiples were earned.

The table below identifies these criteria, as well as an approximated weight for each. This weight was determined by the overall impact their absence or presence appears to have had on offers made.

Valuation Factors For Tech Companies, Weighted |

||

| Factor | Description | Weight |

| Cash Flow | Profit sustained over at least a 24 month period | 45% |

| Company Size & Age | An established infrastructure, base of operations, and labor force, sustained over multiple years | 30% |

| Owner Dependency | The ability to replace the owner after a 12-36 month earnout | 15% |

| Customer Base | A growing customer base with high loyalty and low churn | 10% |

It should be noted that additional factors (e.g. geography, specialization) were factored into a company’s valuation. The difference between these smaller examples and the four listed above is that the examples on the table were noted in more than 90% of deals listed, indicating a greater reliance on them on the part of buyers in both PE firms and strategics.

Selling a Tech Company

Anyone who has sold a company before will tell you that it’s a complicated experience, regardless of the seller, industry, or EBITDA range. Despite the lowering of interest rates in mid-2024, the turbulence of the last two years continues to give many buyers pause before committing to a purchase.

I have sold several tech companies myself and am happy to offer advice from a neutral, third-party perspective. You can reach me via the link below or through the contact page on this website.

Business – First Page Sage